Tesla, the renowned electric vehicle manufacturer, experienced a significant blow as its shares tumbled following disappointing car sales in the Chinese market. This setback puts a dent in the company’s otherwise impressive performance and highlights the challenges it faces in one of the world’s largest automotive markets.

Overview of Tesla’s performance in the Chinese market

China has long been a key market for Tesla, and the company has made significant investments in the country to solidify its presence. With the Chinese government’s push for electric vehicles and the growing demand for sustainable transportation, Tesla seemed poised for success. In recent years, the company has ramped up production in China, building Gigafactories and expanding its charging network. However, despite these efforts, Tesla’s sales in China fell short of expectations.

Factors contributing to the disappointing car sales

Several factors may have played a role in Tesla’s disappointing car sales in China. One possible reason is luna togel increased competition from local electric vehicle manufacturers. Companies like NIO, Xpeng, and Li Auto have gained popularity in China, offering competitive alternatives to Tesla’s vehicles. These local brands often have a better understanding of the Chinese market and cater to local preferences, which may have given them an edge over Tesla.

Another factor that may have impacted Tesla’s sales is the reduction in government subsidies for electric vehicles. In the past, generous subsidies made electric vehicles more affordable for Chinese consumers, driving demand. However, as the government gradually reduces these subsidies, the cost of electric vehicles, including Tesla’s, has gone up. This could have deterred potential buyers, especially in a price-sensitive market like China.

Additionally, concerns about the reliability of Tesla’s vehicles and the availability of charging infrastructure may have influenced consumer purchasing decisions. While Tesla has made efforts to address these concerns, they may have contributed to the slower-than-expected sales in China.

Analysis of the impact on Tesla’s stock price

The disappointing car sales in China had an immediate impact on Tesla’s stock price. The news of the sales slump sent shockwaves through the market, causing the company’s shares to plummet. Investors reacted negatively to the setback, concerned about Tesla’s ability to maintain its dominance in the Chinese market, as well as the potential implications for its global market position.

Tesla’s stock price is closely tied to market sentiment, and any signs of weakness can trigger significant fluctuations. The Chinese market is crucial for Tesla’s growth strategy, and the sales decline raised concerns about the company’s overall performance and future prospects. As a result, the stock price took a hit, highlighting the importance of the Chinese market and its impact on Tesla’s valuation.

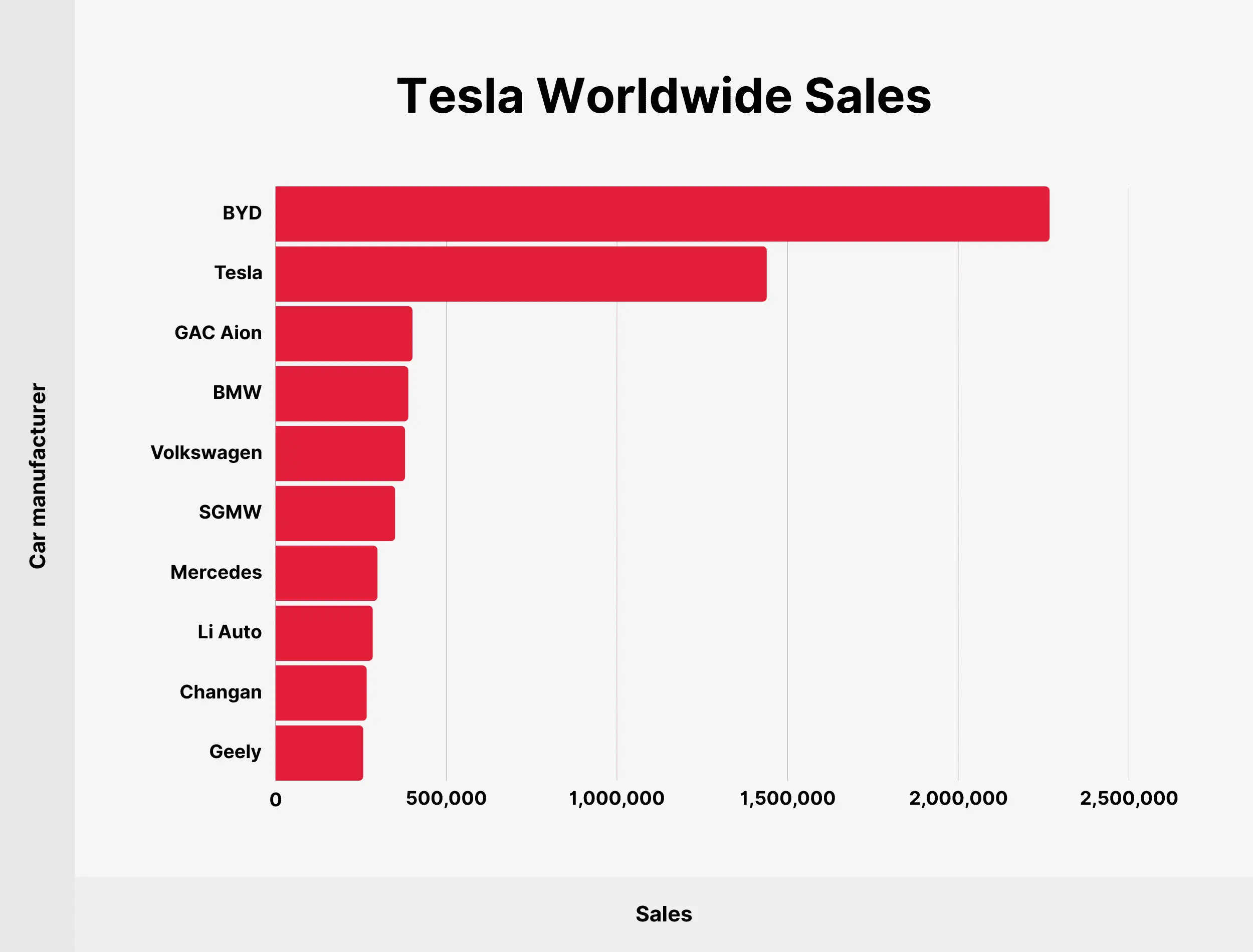

Comparison with competitors in the Chinese electric vehicle market

Tesla’s disappointing sales in China come at a time when local competitors are gaining ground in the electric vehicle market. Companies like NIO, Xpeng, and Li Auto have been able to attract consumers with their innovative features, competitive pricing, and tailored solutions for the Chinese market. These local players have established a strong foothold and have seen significant growth in recent years.

While Tesla remains a well-known brand in China, the increased competition poses a challenge. Local brands have a better understanding of Chinese consumers’ preferences and have tailored their products accordingly. Additionally, the availability of local support and service centers gives them an advantage over Tesla.

However, Tesla still has a strong brand reputation globally, and its technological advancements and charging infrastructure give it a competitive edge. The company’s ability to adapt to market demands and deliver high-quality vehicles will be crucial in maintaining its position in the Chinese electric vehicle market.

Strategies for Tesla to improve sales in China

To regain momentum in the Chinese market, Tesla needs to reassess its strategy and address the factors that contributed to the disappointing car sales. Here are some potential strategies the company can consider:

- Price Optimization: With the reduction in government subsidies, Tesla should focus on optimizing its pricing strategy to make its vehicles more accessible to Chinese consumers. This could involve exploring partnerships with local suppliers to reduce manufacturing costs and passing on the savings to customers.

- Localized Marketing: Tesla should continue to invest in localized marketing efforts to better connect with Chinese consumers. This could include collaborating with local influencers and leveraging popular social media platforms to increase brand awareness and generate interest in its products.

- Improved Customer Support: Addressing concerns about vehicle reliability and charging infrastructure is crucial. Tesla should enhance its customer support services, ensuring prompt and efficient resolution of any issues. Expanding the charging network and ensuring its reliability will also help alleviate consumer concerns.

- Product Innovation: Tesla should continue to innovate and introduce new features and models specifically tailored to the Chinese market. This could involve incorporating elements of Chinese culture and preferences into the design and functionality of its vehicles.

Potential implications for Tesla’s global market position

Tesla’s disappointing sales in China raise questions about the company’s global market position. China is a significant market for electric vehicles, and any struggles in this market could have a ripple effect on Tesla’s overall performance and reputation.

The sales decline in China may impact investor confidence in Tesla’s ability to expand into new markets and maintain its dominance in established ones. It also highlights the need for the company to adapt its strategies to local market conditions and competition.

However, it is important to note that Tesla’s global market position is not solely dependent on its performance in China. The company has a strong presence in other regions, including North America and Europe, and continues to see growth in these markets. Tesla’s commitment to innovation and sustainability, coupled with its robust charging infrastructure, gives it a competitive advantage that extends beyond China.

Expert opinions and market reactions to the news

Industry experts have weighed in on Tesla’s disappointing car sales in China, offering their insights and analysis. Some experts believe that the sales decline is a temporary setback and that Tesla has the ability to bounce back. They point to the company’s strong brand recognition and technological advancements as factors that will continue to attract consumers.

On the other hand, skeptics argue that Tesla’s dominance in the electric vehicle market may be waning. They suggest that increased competition from local players and regulatory challenges could pose significant hurdles for the company in the long term. These differing opinions have sparked intense debates among investors and analysts, leading to further volatility in Tesla’s stock price.

Long-term outlook for Tesla in China

Despite the recent sales slump, the long-term outlook for Tesla in China remains promising. The Chinese government’s commitment to reducing carbon emissions and promoting sustainable transportation aligns with Tesla’s mission and provides a favorable market environment.

Tesla has already made significant investments in China, including the construction of Gigafactories and the expansion of its charging network. These infrastructure developments, coupled with the company’s technological advancements, position Tesla well for future growth in the Chinese market.

However, Tesla needs to learn from its recent setback and adapt its strategies accordingly. The company must address concerns about pricing, reliability, and charging infrastructure to regain consumer trust and maintain its market share. By leveraging its strengths and continuously innovating, Tesla has the potential to reclaim its position as a leader in the Chinese electric vehicle market.

Key takeaways

Tesla’s disappointing car sales in China have sent shockwaves through the market, impacting the company’s stock price and raising concerns about its global market position. The factors contributing to the sales decline, including increased competition, reduced subsidies, and consumer concerns, highlight the challenges Tesla faces in the Chinese market.

To improve sales in China, Tesla needs to reassess its strategy and consider price optimization, localized marketing, improved customer support, and product innovation. These strategies, coupled with Tesla’s brand recognition and technological advancements, can help the company regain momentum and maintain its dominance in the Chinese electric vehicle market.

While the setback in China is significant, Tesla’s long-term outlook remains promising. The company’s commitment to sustainability, coupled with the Chinese government’s push for electric vehicles, creates a favorable market environment. By addressing consumer concerns and leveraging its strengths, Tesla has the potential to bounce back and continue its growth trajectory in China and beyond.

Key takeaways from Tesla’s sales slump in China include the importance of understanding local market preferences, the impact of government subsidies on consumer demand, and the need for continuous innovation and adaptation in the rapidly evolving electric vehicle industry. As Tesla navigates these challenges, it will be interesting to see how the company rebounds and maintains its position as a leader in the global electric vehicle market.

If you found this analysis insightful, we invite you to further enrich your understanding by exploring our article on Xi Jinping, offering valuable insights into China’s leadership and its impact on various industries. Thank you for joining us on this exploration.